The accusation, itself, will become the source of the media's attention and the truth of it will be buried in political hijinks. I put nothing past the shenanigans of either party, and made-up news is likely to be the story of our days ahead as there will be less and less time to disprove anything. The civility in politics has turned into no civility and who knows what vicious tricks may be pulled, as our election day nears.

As a matter of this warning, I think that there is a high probability that it may be needed. There are dividend stocks, Exchange Traded Funds, closed-end funds, get some income and a cash flow because it may be needed. So, another answer, before a potential political shellacking, is income. Well, before we hit the skids, I am telling you. The merry men at Robinhood, could soon learn a very serious lesson. This has worked so far, in many cases, but a good political surprise, or two, could send this strategy to the ground. When there is no yield left, or almost none, money has gravitated to the "appreciation plays" as a matter of necessity for many people and institutions. In my view, a lot of bond money has become equity money as a matter of necessity. Cash has been demoted and while it still provides some safety, mostly as a key to re-entry, the value of holding it is a costly experience.

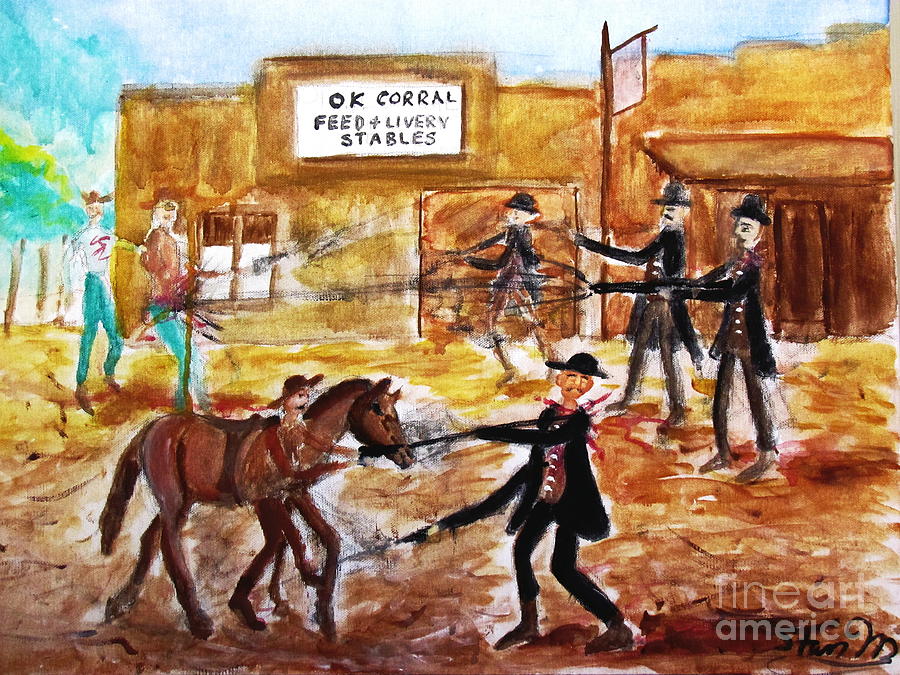

Gunfight at the o.k. corral participants free#

There was a time when you got a free toaster for opening up a new bank account, but those days are long gone and while cash still has a value, it is not what it used to be, in my estimation. All fine and dandy except that cash, now, yields nothing, and so there is a cost for this maneuver and that is income. The easiest response then is to have additional cash. Day by day we are at historically low yields, or just off of them, and so the bond play has yielded its presence in our current markets to our current reality. What we face is not "relative value" but "absolute value" with Treasuries, corporates and mortgage backed bonds yielding just this side of Zero. In normal times, there would be a push out of equities and into bonds as the "safe haven" play. They could come from any debate, Nancy Pelosi's dream come true that there is no debate, or a myriad of accusations, surely coming, that could put the markets in a tailspin, once they rear their ugly heads.

Moreover, the days leading up to the election could be filled with surprises. Everyone prefers "same old, same old" but this is not the case in this election, and so it must be recognized. Take what side you like but the uncontestable reality, in my opinion, is that America is being presented with two very stark choices for the country's future and that the markets, the closer we get to the election, may become very volatile and quite unruly. I submit that this is not the case in our forthcoming election. There were differences, but not material differences. In most elections, each party has been a little bit to the left, and a little bit to the right. The participants in the markets stand back, look around, and then place their bets, and all of this is a normality for all of us, that play in the "Great Game." Each and every day the markets are swayed by what the politicians are doing, and what they are likely to do. There has been no let-up in this for hundreds of years.

0 kommentar(er)

0 kommentar(er)